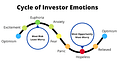

Do you know where you are on the cycle of investor emotions?

The cycle is more common than you think and a great way for clients to identify how their risk tolerance can change.

Depending on who you talk to and what their incentives are, you can get a lot of interesting market outlooks. These overreactions or underreactions can be some of the costliest mistakes an investor can make. JP Morgan has a study that shows how retail investors underperform the markets significantly, sometimes as low as a 2.3% annualized rate of return:1

You may have heard the old investment adage “buy-low, sell-high,” but let’s agree that this is much harder to do in practice. This only gets more difficult as YOUR dollars become at risk and those $1,000 swings become $100,000 swings.

In previous posts, I described that the average physician client has a net worth of $3,250,000. For illustrative purposes, let’s assume that this entire amount is in a brokerage account and susceptible to normal market volatility.

Average Daily Account Change of 1% = $3,250

Average Annual Correction of 14% = $455,000

Average (roughly every 5 years) Bear Market Correction of 33% = $1,072,500

These numbers are big enough to make anyone take a pause before investing. It also helps highlight an investment problem.

How much would your investment account lose before you got nervous and pulled your money out of the market?

This behavior is one of the leading drivers for why retail investors underperform the market over time. Once the investments are sold, when is the right time to invest again? This gambler’s dilemma compounds one bad decision into a major issue.

Looking at the JP Morgan study, investing $100,000 in the S&P to compound at approx. 8.2% per year for 20 years results in $483,665.62. Compare that to the average investor return of 2.3% over the same time period which would yield $157,584.20. That is a difference of $326,081.42!

The way to avoid this is to keep the investor emotion cycle in mind. Things tend to get worse before they get better. Have a long-term plan in mind and reference it regularly to keep yourself on the right track.

This is also one of the roles of your financial advisor - an accountability partner who should help you understand what your risk tolerance is and balance you out when things are going better or worse than you expect.

https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/